Learn how bunq integrated gambit's

wealth as a service technology.

1. About

‘Easy Investments’ is the new sustainable service offered by the online bank bunq. The neobank uses Wealth as a Service technology developed by Gambit allow their money in a regular and very simple way in environmentally friendly funds.

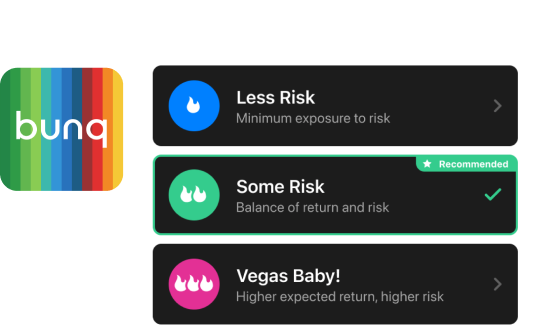

Easy Investments was launched in early 2022 and offers several portfolios depending on the client’s risk profile :

Less Risk: Minimum exposure to risk

Some Risk: Balance of return and risk

Vegas Baby: Higher expected return, higher risk

2. What was the objective?

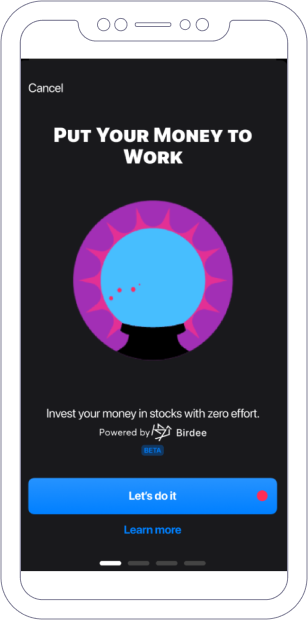

Bunq’s goal was to make investing easy and accessible to some of their customers without them having to make any effort. To achieve this, Easy Investments relies on the robo-advisor technology developed by Gambit.

Thus, bunq clients can invest their money without any special knowledge in finance. Thanks to a combination of algorithms, the investor chooses a portfolio adapted to his/her personal objectives and risk profile and can follow the performance of his/her portfolio easily and at any time.

3. Personalized customer journey on top of our APIs

A clear presentation of the investment offerand at any time.

.png?width=308&height=620&name=phone%20(1).png)

A gamified approach to risk profiling

.png?width=308&height=620&name=phone%20(2).png)

A projection and graphic visualization of the expected gains

4. In a nutshell, Easy Investments is:

- An investment service available in Germany, France, Luxemburg, Belgium and the Netherlands and 2 market openings in progress.

- A user-to-investor conversion rate of more than 50%.

.png?width=73&height=70&name=Group%20(2).png)

5. Engage with your customers through an outsourced digital wealth solution

.png?width=440&height=618&name=Frame%2013%20(1).png)

Digital regulatory compliant onboarding and administration

.png?width=440&height=618&name=Frame%2014%20(1).png)

Automatic and personalised wealth management

.png?width=440&height=618&name=Frame%2015%20(1).png)

A projection and graphic visualization of the expected gains